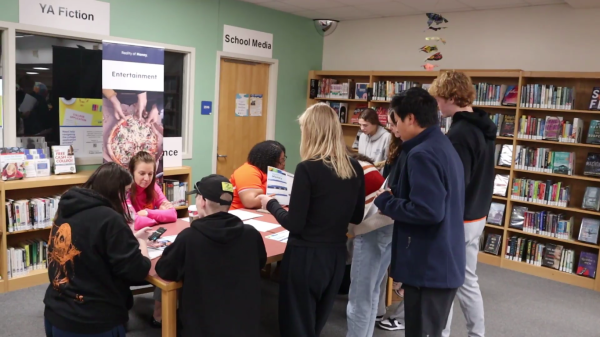

The Reality of Money is an event hosted by the State Employees’ Credit Union to teach students about budgeting as an adult. The event was hosted from 8 a.m.- 2 p.m. on Nov. 16. About 200 Athens Drive students and their teachers went to the library for the event.

“[Reality of Money] allows students to make a budget based on the situation that the simulation gives them,” said Eric Luffman, Social Studies teacher at Athens.

The SECU is a large Credit Union in North Carolina and has various financial education programs to help students learn how to use money in the real world.

The school has a partnership with the SECU, which allows them to organize events with the Credit Union.

Melonie Carlton is the Career Development Coordinator at Athens, which means she helps students with “anything career-related.” She also helped organize the Reality of Money event with the SECU.

“I’m the connector between the SECU and the school,” said Carlton.

The event itself consisted of 12 different stations that acted as different expenses students can expect to encounter as adults.

“The 12 stations each had a slice of life that you have to navigate as an adult. Everything from buying/renting a house, buying groceries, childcare, buying a car, etc.,” explained Luffman.

Students also had a special profile, which contained different statistics about their new life, such as credit scores, salaries, and family members that affected their journey throughout the event. For example, a student could get a great credit score, but mediocre income, and they’d have to adapt to that situation.

“I noticed that in areas where I splurged more, I had to save in other areas to compensate.” said Dylan Ducatte, a student who attended the event.

“[The event] ties in the limitations that you might have based on your particular financial situat

ion,” said Luffman.

With these mechanics, students were able to gain experience on working with money and budgeting.

“I think we often underestimate life’s true expenses. I felt cautious with my financial decisions,” said Ducatte.

Due to the experience that students got from the event, they felt more confident in their financial skills.

“I think it all boils down to making conscious decisions and being able to calculate the risks and rewards,” said Ducatte.

So, with the Reality of Money event, students were able to learn a lot more about how to be financially knowledgeable once they graduate.

“[Basically,] Reality of Money gives them (students) an overview of how to budget like an adult on a monthly basis,” said Carlton.